I just finished the first part of the CPA’s public sector certificate program. This blog is to put down some notes and thoughts on the course and also a suggestion for CPA Alberta/Canada about what next to do with this program.

Kudos to FMI and CPA for a Focus on the Public Sector

Thank you to CPA Canada and their partner, the Financial Management Institute (FMI) for developing this program. I can’t say that I have done an exhaustive search but I am pretty sure that this course is unique in Canada for discussing how the public sector differs from our private sector peers. As well, a good portion of the course focuses on Canadian Public Sector Accounting Standards (PSAB – the B standards for Board).

To be honest, I have kind of missed out studying PSAB. The standards were not part of my training twenty years ago (and they have come a long way during this time anyway). Being a ‘budget-guy’ I had a transient need to know the standards. Thanks to this course, I have a better understanding of what they are and that they are actually pretty good. By way of overall content, the course offered the following topics:

- Module 1: Governance and decision-making processes (budgets, legislature, etc.)

- Module 2: The public sector planning and budgeting process.

- Module 3: Government operating and capital budgets.

- Module 4: public sector accounting standards including dives into:

- Concepts & Principles (1000 —1300)

- Financial Reporting (2100 —2700)

- Financial statement items (3030 —3510)

- Not-For-Profit Organization Accounting (PS 42**)

- PSAB Statement of Recommend Practice.

- Module 5: Decision Support

-

Module 6: Auditing.

Modules 1-4 were pretty good, Module 5 very weak and Module 6 was a bit of strange. It seemed to be cobbled together or directly lifted from another program. To support the above modules, the course referenced a number of real life examples and some pretty good reference material. Unfortunately the material was a bit stale (generally 2+ years old or older) and as such could use a refresh.

A final kudo is the software that CPA Canada used for this course. Called Brightspace, it is a learning management system from Desire to Learn (D2L) a Canadian company out of Kitchener Ontario. Brightspace was clean, intuitive and easy to navigate. I did my MBA online (through Athabasca) using the then state of the art Lotus Notes, D2L is definitely a step in the right direction.

Needs Work Though

Although I thought the course was a good use of my time, I personally think that it needs work. The following are some suggestions for CPA for its next course re-write:

- What Learning Gap is Being Addressed: This is a post-designation course and as such I was expecting material aimed at someone working in the public sector. Instead, the course went down a few rabbit holes such as calculating current ratio. As a result, I think CPA needs to better analyze and think about the target audience and their educational needs of those taking this course.

- Hire an Editor. I suspect that portions of this course were mashed together from a variety of sources. In fact the last module (#6) did not even bother to change the original audience in the content. This course is important enough to have hired an editor and is pricey enough ($1K CAD) to have expected one.

- Refresh the Content. For a new course, it references a good number of circa 2012 era materials. As well, the Value for Money section of Module 6 uses a now withdrawn document but does not even mention PS 5400 and 6410 assurance standards on Value for Money audits. For a new program I would have expected at least circa 2015 material.

- Have some Interaction. One of the reasons I signed up for this program was because it had some high-flying contributors. I saw neither hide nor hair of them. I did notice later on (after I had abandoned the discussion board) that the a newly hired moderator was making an valiant effort to encourage group discussions.

- More than Traditional Accounting. The course covered a variety of topics at a cursory level such as budgeting, costing and the audit function. The course could easily expand into other common facets of the public sector experience. For example, how to brief and interact with the political level; the challenges of systems in the public sector and how about a bit on the weird world of public sector procurement.

Worthy of a Core Module?

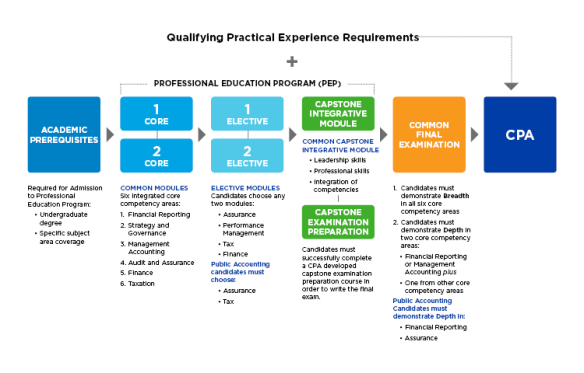

Notwithstanding some of the above tweaks and enhancements, I believe this course (or its improved successor) should be at least an elective if not potentially a core module in the PEP program. For those unfamiliar with the training to become a CPA, individuals must complete electives and core modules in such traditional areas as financial reporting, tax, audit or management accounting as part of CPA’s Professional Education Program or PEP.

I would not recommend that the existing course be either as it really needs some work and lots more relevant content while jettisoning the audit and financial performance elements which are covered in other PEP modules. In addition, I would expand the dive into PSAB and likely include something like a mentorship program with seasoned accountants who live and breath PSAB.

To this last point, the course could be delivered using interaction with local governments. I know here in Edmonton, students taking this module could also meet with the provincial controller, municipal CFOs or senior financial managers from the federal level.

Next Steps

I plan to reach out to CPA Alberta to see if they would be interested in running a pilot elective with this course as the basis. I have some thoughts on additional content I would add but there is definitely a good starting point. Once again, kudos to CPA Canada for taking some initial steps in helping accountants who have chosen the public sector path.

At the end of the day, 40 good hours of professional development and I now have information and resources I did not have before starting this course… the sign of a worthwhile use of ones time!