As a member in MEC, I exist in two different forms. I am a customer for a retail outlet and I am a member (shareholder) in a cooperative.

As a member in MEC, I exist in two different forms. I am a customer for a retail outlet and I am a member (shareholder) in a cooperative.

I spent my professional accounting career in the realms of strategy, governance, information technology, public sector and peripheral fields such as risk or project management. Although I have not done financial analysis in awhile, it is still fun to dust off the old neurons and see if they still work.

This weekend, September 26-27, 2020, is important for the Canadian retailer, MEC (formerly the Mountain Equipment Cooperative). A British Columbian court will decide if MEC should be sold to a private equity firm [1]. A grassroots group, SaveMEC, has raised funds and support to oppose the sale. It hopes to send 10,000 letters to the creditors to convince them to delay the sale for a fortnight while alternatives are sought. This blog is 1/10,000 of this support – and some thoughts on alternatives.

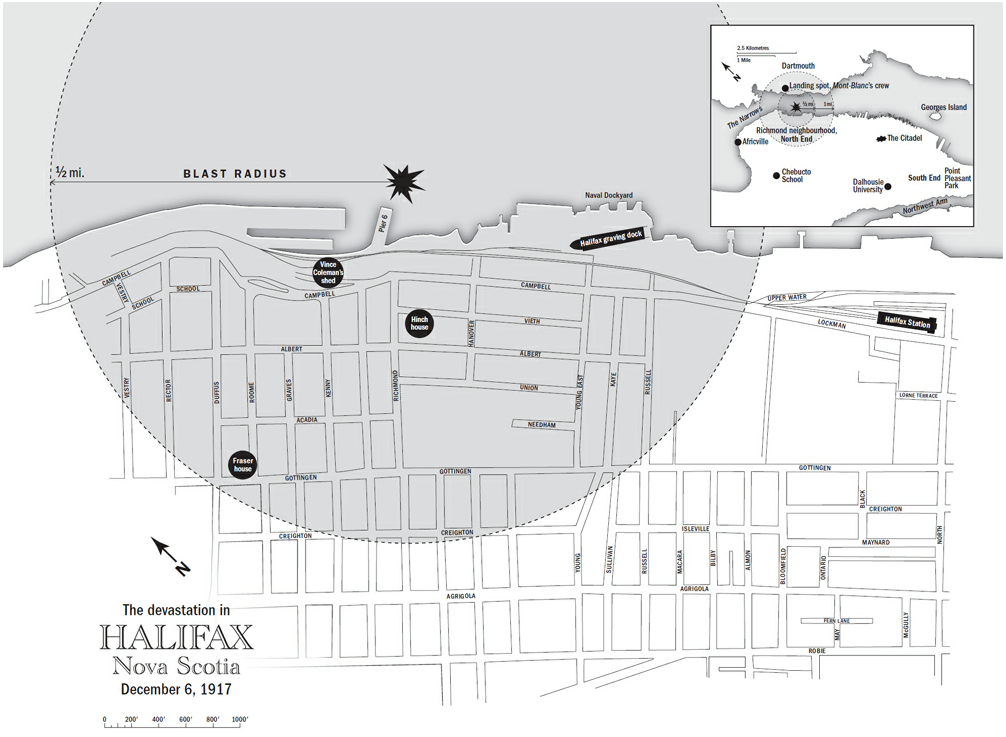

In my ongoing efforts to remember what I have read, some notes on the book, The Halifax Explosion by Ken Cuthbertson.