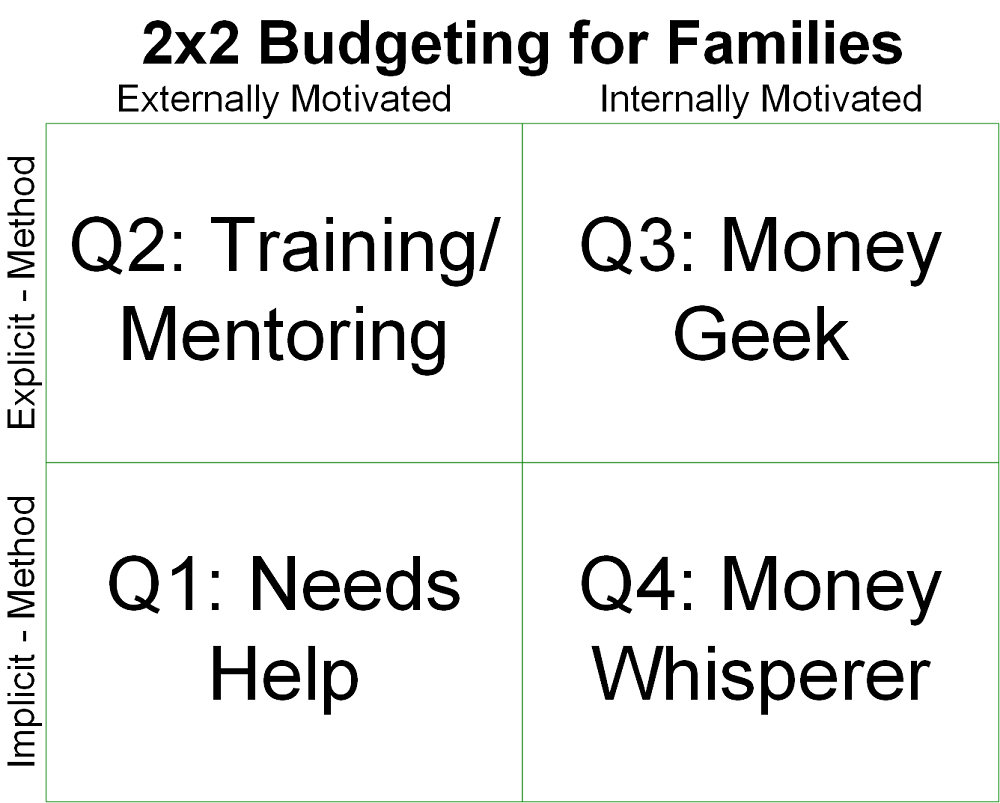

The previous blog, Go Forth and Budget, described two challenges facing a family attempting to develop a household budget: staying motivated and which budgeting method to use. These challenges can be mapped onto a 2×2 Matrix as follows:

2×2 Family Budgeting

Some families are lucky enough to be on the right-hand side of the vertical axis of the quadrant. Families in a financial literacy program are more likely to be on the left and towards the bottom. These axes are as follows.

- Motivation: who and how is the family motivated to track their budget.

- Definition: Motivation is the sustained adherence to tracking and planning for household expenditures and goals irrespective of the source of this motivation.

- External Motivation: A family may be externally motivated by participating in a financial literacy program, mandated by a benefactor (e.g. a family member) or an entity such as a bank or bankruptcy program. External motivation is inherently unsustainable but is useful in the short run to change behaviour.

- Internal Motivation: A family budgets on its own volition. No matter the tools or methods used, there is good compliance to the method. Often this is because the money actions and/or decisions are controlled by one person.

- Technology/Methods: These are the tools used to budget.

- Definition: The methods and tools used to track and plan for household expenditures and goals which the family has actively adopted. For example, every family receives a Credit card statement. This is not a tool. However, checking the transactions to confirm their veracity is a household expenditure tracking method [1].

- Implicit: Implicit methods are those that involve few or perhaps no tools or methods whatsoever. My wife consistently checks every transaction that goes through our accounts, pays every bill on time, knows how much we have left to spend – but does this entirely in her head.

- Explicit: An explicit method is a manual or digital mechanism to do what occurs between my wife’s ears. The most sophisticated finance applications monitor your spending habits and flag expenses that seem out of sorts. Transactions are sliced, diced and roll-forward to the next month’s analysis. A paper calendar or envelope does the same thing but with manual effort. A spreadsheet lies in the middle of these extremes.

The Lifecycle of Money Whisperer

Probably most people spend their lives somewhere in the middle of the four quadrants (In an Okay Place). Other possible locations include:

- 1. In Crisis: Families in financial crisis will be in the bottom left corner of the quadrant, having neither the motivation nor tools to manage and financially-plan. In fact,

- 2. In Training: A financial literacy program ideally gives a family the structure and they will move to be In-Training. The tools and methods in this place are less important than developing the financial motivations and habits.

- 3. In an Okay Place: families in this location may struggle staying motivated and/or finding the optimal tool(s) to track and plan for spending. A family can stay here for decades, fall off the wagon or become compulsive about tracking their spending.

- 4. In the Groove. This is the ideal place for a family. At least one individual is internally motivated and preferably all family members contribute to this motivation. Tools and methods are less important than discipline and consistency of their use.

- In the Know. Some people are more extreme in their financial tracking and planning and end up In the Know about both technologies and motivations. If it is a hobby, great; if it is a compulsion, it might not be sustainable or healthy.

A Word on Technology and Methods

My father started work in Calgary in the mid-1950’s and for the first decade or so of his career he was paid in cash. In the 1960’s this was converted to a pay-cheque and then in the 1980’s to direct deposit. In other words, for my father’s working life, my parents could have used an envelope method of budgeting in combination with a calendar or a note book.

Fast forward to the 2020’s and convincing a twenty-something to own a paper calendar or handle cash would be as much as a challenge as teaching my parents how to use a spreadsheet. In other words, the motivation axis is enduring but the technology and method axis is subject to change. The following list was covered in the previous blog, Go Forth and Budget. It starts with the most manual and includes one of my own creation.

- 100% Implicit: This is my wife. Here is the catch, this only works if you have a good handle on your money – otherwise your budgeting is not implicit, it is imaginary.

- Manual and/or Paper-Based: If your finances are simple and/or computers scare you, consider these methods. Banks give away calendars so a pay-cheque planner costs you nothing but a quiet morning with a cup of coffee in early January to initiate it for the year and then monthly updates [3].

- Online Calendars and Lists: These automate the manual processes described above. They are low tech, cheap (or free, e.g. a GMail account) and are likely to be around for a long time [6].

- Online Spreadsheets: There are hundreds of spreadsheets one can download and start planning and tracking their expenses. I have listed a few in the notes as examples [7].

- The Simplified Family Budget Spreadsheet: With hundreds of spreadsheets to choose from, there is no need to create your own – which is exactly why I decided to create a new one. In all seriousness, I created this one for a Financial Literacy program because it is simple, basic and requires very little technical knowledge.

- Applications. There are a myriad of possible financial applications that can be used. Some free, many charging a fee for more advanced features.

And the Recommended Method is…

… whatever works best for the family.

Developing the discipline and motivation to set goals and then a plan to accomplish the goals is more important than the tool. In addition, the attributes of the family using the tool would be an over-riding consideration. I would start even the most cyber-literate family on a manual spreadsheet to teach core principles and then quickly go to an application.

Other families may stick with a spreadsheet for months or years and may never try an application. Another family may never computerize their budget and cost tracking processes due to lack of technology, skills or interests. A family living somewhere without a mature banking system may even use the jar method successfully. Noting my tool indifference, off to my own spreadsheet: Simplified Family Budget Spreadsheet.

Notes and References

- Eagle eye economists will recognize this as the concept of diminishing returns: Diminishing returns – Wikipedia.

- If you want to read more on my thoughts on budgeting, poke around: Budgeting | Organizational Biology & Other Thoughts (myorgbio.org).

- There are number of resources that describe how this technique works, the following are from a simple internet-search.

- Paycheque Planner/Money Tracker Worksheet, from Alberta’s Money Mentors.

- How to Live on a Budget with a Paycheque Planner, a good overview of the process from MyMoneyCoach.

- Paycheck Budgeting, you can download a template from this website.

- Good reasons not to have this much cash laying about includes the obvious threats of theft. If one of the reasons your family is having financial difficulties is because someone has a compulsive personality (gambles, drinks, drugs); having thick envelopes of cash is a temptation beyond pale. The final good reason is that cash sitting in an envelope is doing no one any good. Interest rates may be nominal but having some surplus cash that prevents an overdraft charge is a good investment.

- This line will only get blurrier as technology improves and banks work hard to provide value added services to their clients.

- If you have an email there is a 99.999% chance you also have a calendar. If you own an Android phone, you have a GMail account and therefore a calendar. If you own an Apple phone, you have a calendar. If you don’t own a phone but own a computer, you can sign up for one of a zillion free emails and have a calendar (e.g. GMail, Outlook.com, Yahoo, etc.). If you don’t have a computer, phone or an email – ask for a free paper-calendar from your bank and do your planning manually.

- A search of online spreadsheets for household budgeting is time sensitive. The following are a few resources available in April 2021.

- Google Monthly Budget Spreadsheet – Google.

- Excel Family Budget Spreadsheet – Microsoft.

- Basic personal budget – Microsoft.

- Easy Money Management All-In-One Budgeting Template– Credit Canada.

- Best Budget Spreadsheets – Benzinga.

- Similar to spreadsheet searches, applications are subject to change. Here are some results from April 2021.