This content outlines the characteristics of effective indicators. Key characteristics include validity, reliability, sensitivity, simplicity, usefulness, and affordability. The discussion emphasizes balancing these traits while considering constraints like materiality and timeliness to fulfill users’ decision-making needs and enhance comparability among indicators.

- Hungry to Discuss Indicator Characteristics?

- What Do Accountants Have to Do with RBM?

- Qualitative Characteristics of an Indicator

- The Cost of a Good Indicator

- Other Characteristics Not Considered

- Notes and References

A fresh red apple. The skin is taunt and firm with nary a soft spot noticeable to the touch. The skin is waxy indicating that the fruit’s moisture has been retained. This apple’s variety has a dark red skin; this apple is a perfect example, without blemishes or green spots. A sniff takes in its aroma: pleasing to the nose with a slight citrus note.

Hungry to Discuss Indicator Characteristics?

These are the characteristics of a great apple. Without even taking a bite, you are nearly guaranteed a pleasant eating experience. While not as tasty as an apple, indicators also have ideal characteristics which suggest (but don’t guarantee), the measure is a good fit for the Output, Outcome, or Result.

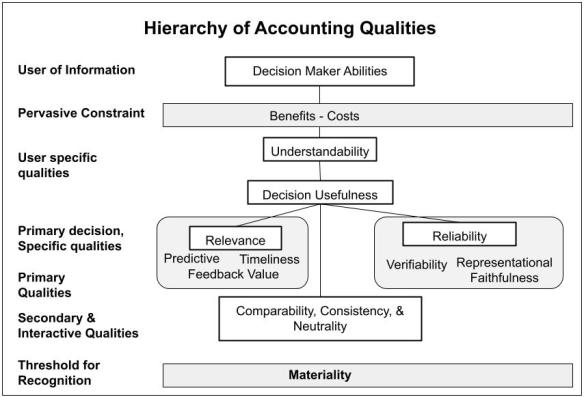

Terminology and what is exactly included varies between different sources. The six characteristics in the opening graphic are common to most sources with the first three common to all. Note that these terms are seldom defined explicitly. While a dictionary definition will often suffice, where possible I have adapted the definition from the accounting world.

What Do Accountants Have to Do with RBM?

A long standing right of passage for every accounting student, typically in their first year, is to learn about the Qualitative Characteristics of Financial Reporting. These characteristics underpin what accountants strive to do when preparing an organization’s ‘statements’. As such, they are defined in the respective accounting standards and as such, have weight as they define what the reader of statement should expect from reports.

I am using definitions from the Canadian, International, and International Public Sector Accounting Standards [1].

Qualitative Characteristics of an Indicator

Validity

RBM Definition: The measure is based on truth, reason, and/or can be reasonably accepted an indicator of what it purports to represent. Not every measure will be a perfect fit and, validity may need to be ‘good enough’.

Reliability

RBM Definition: Reliability: An indicator is free from substantial error and bias and can be dependent upon by an Audience member faithfully represents the underlying Output, Outcome, or Result. It can be collected and managed consistently with no loss of information fidelity over time.

Accounting Equivalent – Reliability: Reliable information is free from material error and bias and can be depended on by users to represent faithfully that which it purports to represent or could reasonably be expected to represent.

Sensitivity

RBM Definition: The measure is attuned to changes in underlying conditions. The reported values are easily changed but with the consideration of false positive/ negative results.

Simplicity

RBM Definition: The measure has a common understanding across multiple audiences who have similar interpretations. It is also straightforward to collect and manage. Nuances and variations are kept to a minimum.

Accounting Equivalent – Understandable: Information is understandable when users might reasonably be expected to comprehend its meaning. For this purpose, users are assumed to have a reasonable knowledge of the entity’s activities and the environment in which it operates, and to be willing to study the information.

Usefulness

RBM Definition: An audience member can use the measure to understand past events and reasonably predict future events. Training and documentation about the measure may be required to increase its usefulness.

Accounting Equivalent – Relevance: Information is relevant to users if it can be used to assist in evaluating past, present or future events or in confirming, or correcting, past evaluations. In order to be relevant, information must also be timely.

Affordable

RBM Definition: The measure can be collected within the resources available to the organization. The benefits of collecting the information outweigh these costs as evaluated by other characteristics. The measure must be affordable to collect over the expected life of the Project or Program.

Accounting Equivalent – Balance between Benefit and Cost: The balance between benefit and cost is a pervasive constraint. The benefits derived from information should exceed the cost of providing it. The evaluation of benefits and costs is, however, substantially a matter of judgment. Furthermore, the costs do not always fall on those users who enjoy the benefits. Benefits may also be enjoyed by users other than those for whom the indicator was prepared.

The Cost of a Good Indicator

“The perfect model of a system is the system itself.”

“Don’t Mistake the Map for the Landscape”

“All models are wrong, but some are useful”

An indicator will always be less than the thing it is trying to measure. When considering an indicator, it is always a compromise between the above characteristics. Once again, accountants have considered the tradeoffs in their discussion of the “Constraints on Relevant and Reliable Information“. Key elements of this consideration include:

Materiality

Information is material if its omission or misstatement could influence the decisions made on the basis of the financial statement. Materiality depends on the nature or size of the item or error judged in the particular circumstances of its omission or misstatement. Thus, materiality provides a threshold or cut-off point rather than being a primary qualitative characteristic which information must have if it is to be useful.

Timeliness

How quickly is the information available, how much loss in fidelity has there been to achieve that speed?

If there is an undue delay in the reporting of information, it may lose its relevance. To provide information on a timely basis it may often be necessary to report before all aspects of a transaction are known, thus impairing reliability. Conversely, if reporting is delayed until all aspects are known, the information may be highly reliable but of little use to users who have had to make decisions in the interim.

In achieving a balance between relevance and reliability, the overriding consideration is

how best to satisfy the decision-making needs of users.

Balance between Qualitative Characteristics

A balancing, or trade-off, between qualitative characteristics is often necessary. The aim is to achieve a balance in order to meet the objectives of the indicator. The relative importance of the characteristics in different cases is a matter of professional judgment and consensus between the 5 Audiences.

Other Characteristics Not Considered

The following characteristics governments may want to consider when selecting indicators.

Comparability

Audience decisions involve choosing between alternatives, for example, investing in one project or another or expanding or contracting one program, versus another. Consequently, an indicator is more useful if it can be compared with similar information about other entities and with similar information about the same entity for another period or another date.

Notes and References

- Why So Many Standards? Canada continues to use its own accounting standards despite being a strong supporter of both the International Accounting Standards (IAS, used by For-Profit organizations) and International Public Sector Accounting Standards (IPSAS, used by governments and international organizations).

Pingback: The Construction of a RBM Indicator | Organizational Biology

Pingback: Introducing government Results Based Management | Organizational Biology