On July 1, 2016, CPA Alberta marked one year since the Chartered Professional Accountants Act was enacted. To assess the merger of legacy bodies’ impact, a conference was held addressing regulatory excellence, public sector accounting standards, member engagement, and hiring trends, highlighting ongoing challenges and future strategies for the profession.

On July 1, 2016, CPA Alberta celebrated its first anniversary of the proclamation of the Chartered Professional Accountants Act.

Since this time, considerable effort has gone into making the merger of three legacy accounting bodies successful.

To better understand this and its impact on public sector financial professionals, CPA Alberta and the Financial Management Institute – Edmonton Chapter (FMI) co-sponsored a conference on November 17, 2016 entitled: After the Smoke Clears: CPAs and the Public Service.

A special thank you to Robert Half International who was a conference sponsor and to PwC Canada who is a great friend of FMI – Edmonton.

- Event Overview

- The Presenters, Panel and Hosts for the Event.

- Rachel Miller, CEO of CPA Alberta began the presentations

- Roger Ermuth – Federal Perspective

- Kevin Johnson – 2017 Hiring and Compensation Trends

- Suggested further reading and links:

Event Overview

The event was a combination of three presentations and an hour-long question and answer period (see my previous blog on how ‘Questions a la Carte’ was used to manage this portion of the presentation) The following are my notes and impressions of how the CPA merger in Alberta (and Canada) will impact the profession, the public sector and how can public sector accountants sustain and improve the trust/value in governments demanded by citizens and taxpayers?

Note that although specific presenters are mentioned, these notes are a composite of presentations, panelist discussions and additional content not presented but relevant to the topic at hand. The speakers have [pending] reviewed their sections and made changes but please keep the blending of content in mind for attribution or if quoting this material.

The Presenters, Panel and Hosts for the Event.

- Rachel Miller, Chief Executive Officer, CPA Alberta

- Roger Ermuth, Assistant Comptroller General, Financial management Sector, Treasury Board of Canada Secretariat

- Kevin Johnson, CPA, CMA; Managing Vice President, Robert Half

- Darwin Bozek, Acting Senior Assistant Deputy Minister, Alberta Treasury Board and Finance.

- Dan Stadlwieser, Acting Controller, Alberta Treasury Board and Finance.

- Larry Brownoff, Director, Professional And Career Services (for Rachel Miller).

- Glen Jarbeau: Chief Financial Officer, City of Spruce Grove.

- Laura Daniels: Partner, Assurance , PwC Audit Practice

- Moderator/Presenter; Melissa Banks, Assistant Deputy Minister, Ministry of Labour.

|

Question, Discussion and an Aside: Content within a quote box such as this one was discussed during the panel portion of the program. |

Rachel Miller, CEO of CPA Alberta began the presentations

Rachel Miller provided a recap of the past year’s work and the future for CPA Alberta. She also provided an overview of the current organization including the legislative mandate of CPA Alberta to:

- Protect the public

- Maintain the integrity of the professional

- Increasing the competency of the members and

- Regulate the conduct of members.

CPA Alberta 2014-17 Strategic Priorities

To carry out this legislative mandated, CPA Alberta is commencing updating its current 2014-17 strategic plan which has the following five strategic priorities:

- CPAA Culture: Develop and support a constructive and forward-looking culture for CPA Alberta that embraces our operating principles.

- Regulatory Excellence: Successfully maintain enabling legislation and regulatory oversight that protects the interests of Albertans and enhances the CPA brand in Alberta.

- Education (Pre and Post Designation): Successfully deliver CPA pre-certification education programs and conclude legacy education programs, including support to students requiring transition. Ensure the supply of required Continuing Professional Development and develop innovative programs that enhance the value of membership.

- Member Relevance: Develop and deliver meaningful products, services and events that are sought after and valued by members and build membership engagement.

- Operational Excellence: Ensure that the supporting organization has the necessary tools and resources of a first class professional organization.

Are the current Public Sector Accounting Standards Serving the Public? At a macro level, private and public standards [e.g. International Financial and Reporting Standards (IFRS) versus Public Sector Accounting Standards (PSAB)] serve the same purpose. At a more detailed level however, they are very different. The public is looking for information that is more timely to evaluate and assess whether the government is doing what it set out to do. Are the financial statements giving the public accurate information to answer these questions – currently likely not. The above challenge is important given the competing information sources from social media that may be more timely but also more biased or less accurate. In addition, within the public sector documents such as the budget are acknowledged to be much more important than the financial statements. Beyond the standards there is an opportunity to challenge why things are done differently across government levels let alone organizations at the same level. CPA has a role to play in setting standards and acknowledging when differences are not only permitted but should be encouraged to best serve the public. PSAB will need to incorporate the known differences between public sector organizations. Some elements of the standards are non-negotiable and all organizations must follow. Other components must be optional, scalable enough to fit very diverse organizational needs. |

2016-17 CPA priorities are:

- Fulfill Chartered Professional Accountants Act mandate to protect the public, protect the integrity of the profession; promote and increase the competency of registrants; and regulate the conduct of registrants.

- Complete efficient blending of all functions and services.

- Provide relevant and high-quality products and services to members of CPA Alberta.

- Continue to ‘smart’-grow the profession.

- Continue to advance the profession and its values to the public.

Current CPA Alberta Demographics

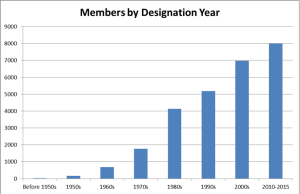

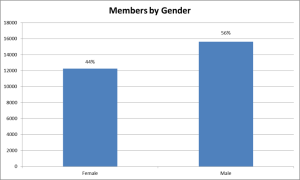

CPA Alberta has a fairly young membership with more than half of all members having received their designation in the last 15 years or more recently.

Nearly half of all CPAs are women who also make up a higher proportion of new members.

Roger Ermuth – Federal Perspective

Assistant Comptroller General, Financial management Sector, Treasury Board of Canada Secretariat

Modern Comptrollership Financial Management Model

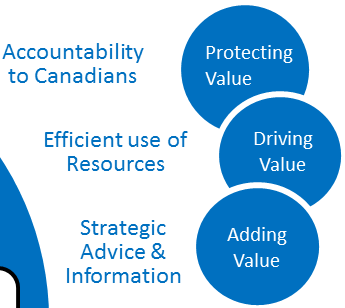

Roger Ermuth had a single slide but it packed a wallop. The slide discussed the federal government’s thought leadership of modern comptrollership (see the graphic below).

Top Right: the Values

The core values of any public sector financial management organization is expressed in the three values of:

- Protecting Value: what the average citizen may think of accountants: gate keepers of the crown jewels of an organization.

- Driving Value: looking for efficiency within an organization.

- Adding Value: transforming the business and adding value both directly and indirectly

Bottom Left: the Federal Government Priorities for Controller General

Policy Reset and FM Transformation are primarily relevant to federal government audience and thus were not discussed in detail. Talent Management and Costing cut across all public sector organizations.

Talent Management: A particular concern is the retiring baby boomer and how to back fill the vacated spots and lost experience. There are many strategies two of which are good internships and cooperative education.

|

Executive Training within the Federal Public Service The federal government is working with CPA to tailor the pre-designation program to include a component for executives who have advanced in their finance careers without an accounting designation. Such advancement was possible in prior years – this tailored program thus will take advantage of both the executive’s experience while equipping them with CPA concepts and training. Another resource is the CPA-FMI Public Sector Certificate Program. |

Talent management is an unexploited opportunity to increase the amount of cross-pollination between the levels of government and other organizations (e.g. Agencies, Board, Commissions, First Nations, International organizations, etc.). There is a geographic challenge to do this when public servants have children and family commitments – but these can be overcome and the value to do so outweighs these considerations.

Costing and in particular Activity Based Costing has a potential place in the public sector but different from how it is used in the private (e.g. manufacturing sector). In the private or for profit context is used to ask questions like ‘is this product really profitable?‘ or ‘what should be the price of this product’? In the public sector context it can be used to understand the resource allocation to a policy decision that results in specific outputs and outcomes. (editors note, this can lead to a number of interesting discussions, for example, should hip replacements be done on patients over the age of 85 relative to the years of quality of life potentially remaining as opposed to concentrating on patients under this age threshold).

Bottom Right: Federal Government Finance Community Strengths and Challenges

Like many finance organizations, the federal finance community is seen as a competent and trusted cadre of individuals with specialized and valued skills useful in the public service. One of the advantages of working in the public sector is the cooperative versus competitive nature of the community. Thus a member of the finance community can reach out to another department (or another government) and get a timely reply on an issue. This is because of a strong sense of community within the public services as well as the role of organizations such as CPA or FMI in promoting this community.

The Three Big Disruptors Impacting the Public Service in the Next Five Years

|

Bottom: Key Results

CPA Canada and public services have two inter-related challenges and opportunities: 1) Maintaining a Solid Core and 2) Helping public Servants to Become What they Aspire to Be. The solid core relates to the accounting ‘stuff’, fiduciary control, stewardship of resources, effective reporting, consistent and comparable results and audit of processes and controls. The aspire part is improving on the core while continuing to be the trusted adviser through strategic thinking, good communication and collaborative approach to processes and problems.

CPA has inherited thought leadership from the three legacy accounting bodies. How can this wealth of knowledge be amalgamated and made available to current CPA members? The solution has to be more than simply ‘dumping’ the content onto a website, it needs some structure and organization to facilitate search and finding. Ideally this content would be available through a more focused and targeted distribution of content to those who need the information at a particular point in time.

Part of this can be done by CPA taking a strong leadership role in pre and post CPA training for the entire career life cycle of its members and those who rely on CPAs (e.g. their bosses, colleagues, etc.). The other part are the CPA members and governments describing their needs and how they would like to access this legacy content.

Is Auditing Working in the Public Sector? Generally yes, but it works best when there is a good relationship and respect between the standards setting organization, the auditor, the organization and the public officials. Each of these parts needs to contribute to the respect so that the public has confidence when there is Good Government and pays attention for when there are areas for improvement. |

Kevin Johnson – 2017 Hiring and Compensation Trends

The following is based on generalities; specific organizations, positions or individuals will vary from the following average and median results.

The hiring environment

- Salaries are increasing: 3.1 per cent average increase and recruiting incentives being provided (e.g. job search services for a spouse).

- For more on this, see the Robert Half 2017 Accounting & Finance Salary Guide.

- Turnover rising: the workforce is becoming increasingly mobile.

- Entry-level upswing: Companies are conducting more campus recruiting.

- For more on this, see: Wanted: Adaptability and Enthusiasm.

- Compensation Trends:

- Public Sector: increasing interest in moving to the public due to reduced volatility, pay / pension. However this is offset by a perception that a talented individual may be a high ‘flight-risk‘ choosing to return to their original industry of choice when the economy turns around.

- Private / Public Industry: Salaries are down by about 10%, however work perks such as shortened work weeks or pro bono days may be used to offset costs. Some organizations are taking advantage of the availability of strong talent now on the market.

- Public Practice: Pay and benefits have increased with the market remaining strong in this sector.

Skills/credentials in demand

- Functional Skills:

- Accountants with industry experience and accredited skills that may include:

- International Financial Reporting Standards (IFRS)

- Generally accepted accounting principles (GAAP)

- Midlevel managers with enterprise resource planning (ERP) are in particular demand

- Financial analysts and finance managers with good problem-solving and decision-making skills.

- Accountants with industry experience and accredited skills that may include:

- Professional credentials:

- Chartered professional accountant (CPA) designation remains the most requested and versatile credential for accounting and finance roles. However, there is interest in the legacy designation when hiring CPAs however.

- MBA (master of business administration) particularly for senior-level finance and analytical roles.

- Other popular credentials include:

- Certified anti-money laundering specialist (CAMS)

- Chartered financial analyst (CFA)

- Chartered global management accountant (CGMA)

- Certified internal auditor (CIA)

- Certified information systems auditor (CISA)

- Certified payroll manager (CPM)

- Payroll compliance practitioner (PCP)

- Project management professional (PMP)

- Interpersonal Abilities:

- Strong communication skills

- Collaborate well with colleagues from different areas of the business.

- For more on this, see: CFOs Seek Finance Professionals With Mix of Hard and Soft Skills.

- Multilingualism, particularly in English and French, is highly valued.

What Qualifies for Professional Development? CPA Alberta follows the International Federation of Accountants (IFAC) criteria for Continuing Professional Development (CPD). This is a minimum of 20 hours per year of which 10 must be verifiable and 120 hours over a rolling three year period of which 60 must be verifiable. CPA Alberta offers assistance in understanding this requirement including in-person and webinars. |

Top positions

The following is based on 2015 data. Note that what is missing from the demand is the middle layer of management. This layer is either being laid off and/or not recruited to. See the impact this will have on organizations in the following discussion on succession planning.

Succession Planning

Part 1 – Who Will Fill the Vacant Seats

Only 13 per cent of professionals said a colleague could easily fill their role if they quit. 58 per cent of executives said their positions would need to be filled externally if they quit (Source: www.newswire.ca: Few Employees Waiting in the Wings). Five additional tips to help businesses enhance their succession planning:

- Start during the hiring process. In addition to the open position, think about the types of advanced roles job candidates could grow into over time. Also, gauge applicants’ interest in building a career with your firm and their leadership skills.

- Take a wide view. Only looking at the top of the company for succession planning is a mistake. Instead, develop plans for all levels. In the process, you’ll identify up-and-comers aspiring to join the management ranks.

- Check with employees. Talk to staff members about their goals, and identify specific steps they can take to reach their objectives. This is also motivational and can help with retention.

- Bolster professional development. Building out succession plans will help you more easily identify skills gaps and the training needed to address them.

- Communicate openly. Let staff know about your goal of preparing them for roles of increasing responsibility, making this a reward for their contributions. Explain the succession process — including what is expected of them and what they can expect from you — and provide prompt updates if there are changes along the way.

The above concerns have been mitigated somewhat because of longer time anticipated to be spent in the work force. This is the result of debt levels of Canadians, erosion of retirement funds, loss of pensions or relying on corporate-cash-out to fund retirement (e.g. selling public or private equity in the employee’s current employer). Retirement 55 is now retirement 60/65 or event 70.

Part 2 – Does the Next Generation Even Want that Seat?

Newer generations are less inclined to work 60-80 hours a week 6-7 days a week. A Generation Y new hire wants to work 8:30-5, plus telecommute on Fridays and perhaps even have a sabbatical every five years.

Part 3 – How to Win the Talent War?

- High Potential Candidates: search for individuals who have worked hard to motivate and inspire their colleagues, kept important projects on track, and ensured satisfaction.

- Establish clear milestones for succession: make a point to provide ongoing feedback to help them progress.

- Create a mentoring program: a valuable way to transfer critical organizational and technical knowledge, foster talent, and promote best practices within the firm.

- Training: provide professional development opportunities.

Suggested further reading and links:

- Questions a la carte methodology: myorgbio.org/accounting-for-questions.

- Financial Management Institute, Edmonton Chapter: fmi.ca/chapters/edmonton.

- CPA Alberta: cpaalberta.ca.

- Key CPA Alberta documents (e.g. legislation): cpaalberta.ca/About-Us/Governing-Documents.

- Canadian Public Sector Accounting Standards (password required): knotia.ca.

- Canada Financial Reporting & Assurance Standards: www.frascanada.ca.