For most people, we accumulate (or not) wealth slowly, year over year. We work, save, spend, borrow and then go back to work. For the (un)lucky few, wealth comes suddenly which can give rise to Sudden Wealth Syndrome (SWS).

Sudden Wealth Defined

Sudden Wealth Syndrome is a term coined by psychologist Stephen Goldbart [1] to describe the stress, guilt, social isolation and confusion that often accompanies a giant windfall. While coming into money ought to be a good thing, it can take a bad turn. Many who find sudden fortune become overwhelmed and start to overspend, grow suspicious of those around them and make poor decisions that lead to family and financial ruin. [2, 3] Four stages of SWS are described [adapted from 2]:

- Honeymoon: love relationship with the money, feeling powerful and invulnerable. Go on spending sprees, make risky investments or can afford poor-choice lifestyles (drugs, sex, gambling, watching cat videos all night, etc.)

- Wealth Acceptance: view of oneself as powerful and invincible is mixed with a sense of vulnerability and the realization for the need to set limits

- Identity Consolidation: accept they are rich, but money doesn’t define them.

- Stewardship: mature resolution of money means to them and have a plan.

The Game of Sudden Wealth

At this point cue the numerous stories of lottery winners who are now living in their mother’s basement or Nicolas Cage [4]. SWS affects those who blow through $150 million (will Mr. Cage please stand up) and those who only get a small bit of wealth. Small fry sudden wealth could be a person receiving an injury payout, a First Nation’s receiving a land claims settlement or someone laid off with a severance package. Thus, while Mr. Cage blew through his big bucks by buying things like TWO albino king cobras, a person on more meager means may have to settle for a single snake [5].

PURPOSE: The Game of Sudden Wealth helps participants to learn lessons about the importance of goal setting, budgeting or wealth management by telling stories of individuals who have made poor choices.

Game Setup

PURPOSE: The Game of Sudden Wealth introduces the concept of Sudden Wealth Syndrome, its definition and treatment. The game also reinforces prior concepts taught such as goal setting, budgeting or wealth management. This is done through creating stories of individuals who have made good and bad choices after becoming suddenly wealthy.

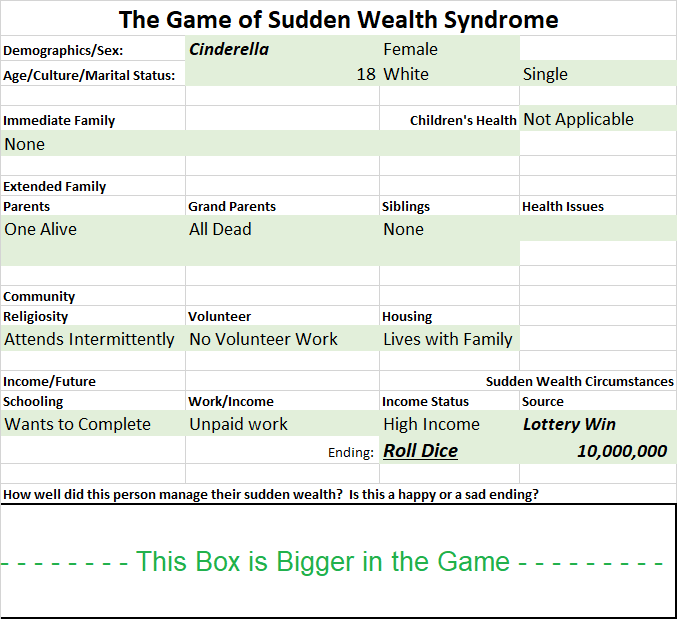

Individuals or groups are given a randomly assigned play card with detailing one persona [6]; examples of situations:

- Name: John, Raj, Mary, Fatima, Jeanne or other culturally relevant names

- Demographics: Male, Female, Other, young, middle-age, senior, race.

- Nuclear Family: single, single parent, married-no children, married-parent, divorced.

- Extended Family: (not) alive parents, grand parents, brothers/sisters.

- Community: religion (church, synagogue, mosque, etc.) involvement, volunteer work, relationship with neighbours, etc.

- Circumstances: Working, good/low-paying job, unemployed, on social assistance.

The Sudden Wealth section describes how the wealth was received and the amount:

- Source: lottery, legal settlement (including land claims), inheritance.

- Amount: $1,000, $100,000, $1,000,000 and $10,000,000.

The Card has an ending which is completed as part of the game play.

How to Play the Game

One card per group/individual is distributed. For optimal learning, groups of 2-5 are preferred (see Seated by Season). The individuals or groups are given a set amount of time (e.g. 2-5 minutes) to think about the person described on the card. They will tell this person’s story from three perspectives:

- How they lived before the sudden wealth,

- What it was like to become wealthy

- Why the ending was what it was.

The ending is random and is selected by rolling a dice for each persona. The possible accounts are as follows:

- Happy

- Okay

- Unhappy

- Tragic

- Your Pick

- Happy

Groups are encouraged to include learnings from the presentation and handouts in constructing the stories (e.g. there was a Happy Ending because of good budgeting or there was an Unhappy Ending because they could not move past the first SWS stage).

Learning Objectives

- Participants will review and incorporate material provided into the stories.

- Extrapolation of content into the fictional characters.

- Normalization and contextualization of the issues and challenges of life before sudden wealth and its impact afterwards.

Game Example

The Cinderella persona was given to a group who then rolled a ‘6’ – a Happy Ending resulting in this story:

“Cinderella managed to sneak out on her 18th birthday and used some saved money to buy herself a birthday present of pop, chips and a lottery ticket. Well her number came up and she won $10 million. After fighting off her step mother and siblings, she moved out west. A few months later her Dad joined her. She paid for his counselling and later they opened an gender-equality institute. This organizations helps men escape emotionally-abusive relationships and protects the rights of fathers and their biological children.

Notes and References

- Founder of the Money, Meaning, & Choices Institute (MMCI).

- Schorsch, Irvin G. “Too Much, Too Soon: How to Avoid Sudden Wealth Syndrome | HuffPost Life.” HuffPost, September 6, 2012. https://www.huffpost.com/entry/sudden-wealth-syndrome_b_1652701?guccounter=1.

- Okay, am I the only person who thinks that establishing an institute to help manage Sudden Wealth was the most brilliant business idea EVER! As trained, psychologists, why listen to poor people whine and complain when you can listen to RICH people whine and complain.

- TOOO Numerous to list as references, Google it and then plan to go down an internet-rabbit hole for a few hours.

- Found whilst down the aforementioned rabbit hole. Really Nick, for ‘sexual purposes’? https://financebuzz.com/finance-nicolas-cage-buying-spree.

- See Citizen Centeric Experience to learn more about personas.